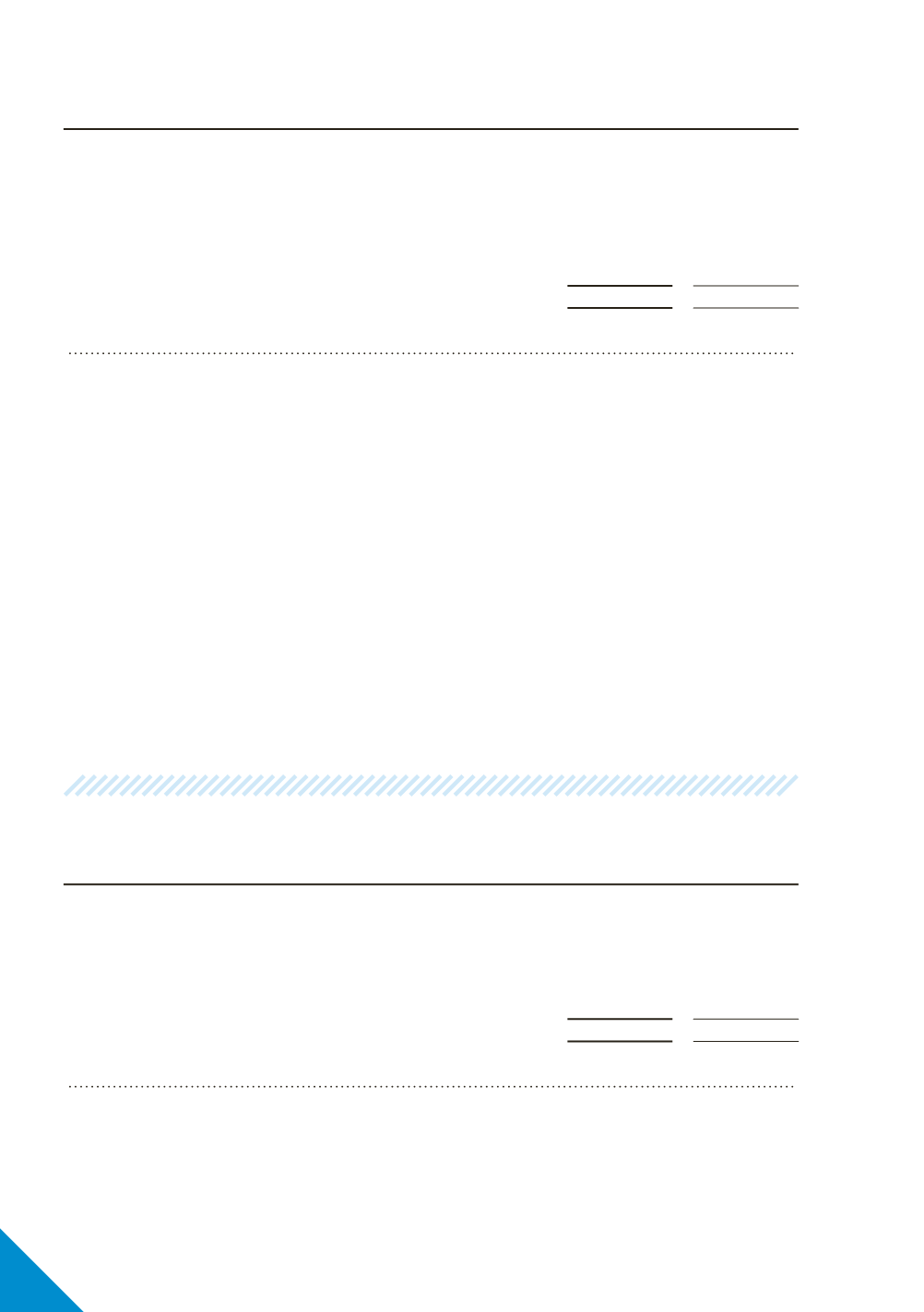

Note 07

Current assets - Cash and cash equivalents

Consolidated

2012

2011

Notes

$’000

$’000

Cash at bank and in hand

(b)

45,924

33,513

Deposits at call

(c)

-

90,114

45,924

123,627

(a) Interest rate risk exposure

The Group’s exposure to interest rate risk is

discussed in note 2.

(b) Cash at bank and in hand

Cash at bank and in hand earns interest at

floating rates based on daily bank deposit rates.

Refer to note 2 for rates earned.

(c) Deposits at call

The “deposits at call” at balance date reflects

funds available to the Group that have been

placed on deposit with major Australian banking

institutions and across a spread of short‑term

term deposits in accordance with Board approved

Treasury Policy. Refer to note 2 for information

regarding interest rate and credit risk.

(d) Fair value

The carrying amount of cash and cash equivalents

equals the fair value.

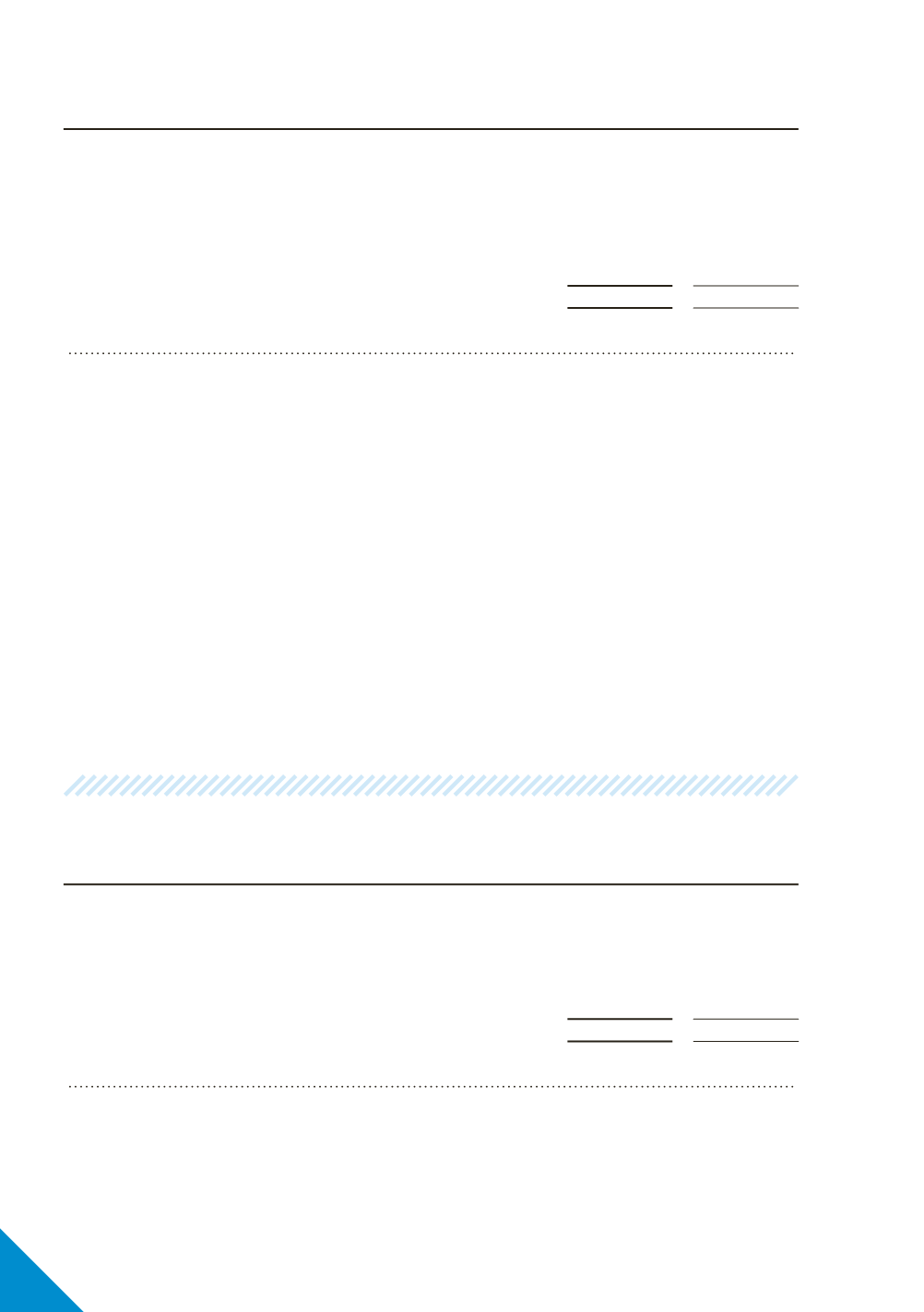

Note 08

Current assets - Held to maturity investments

Consolidated

2012

2011

$’000

$’000

Held to maturity investments

-

20,418

-

20,418

The “held to maturity investments” are term

deposits invested for a period greater than 90

days, but not more than 182 days in accordance

with Board approved Treasury Investment Policy.

The weighted average interest for the year ended

30 June 2012 for held to maturity investments

was 5.83% (2011: 6.10%).

82