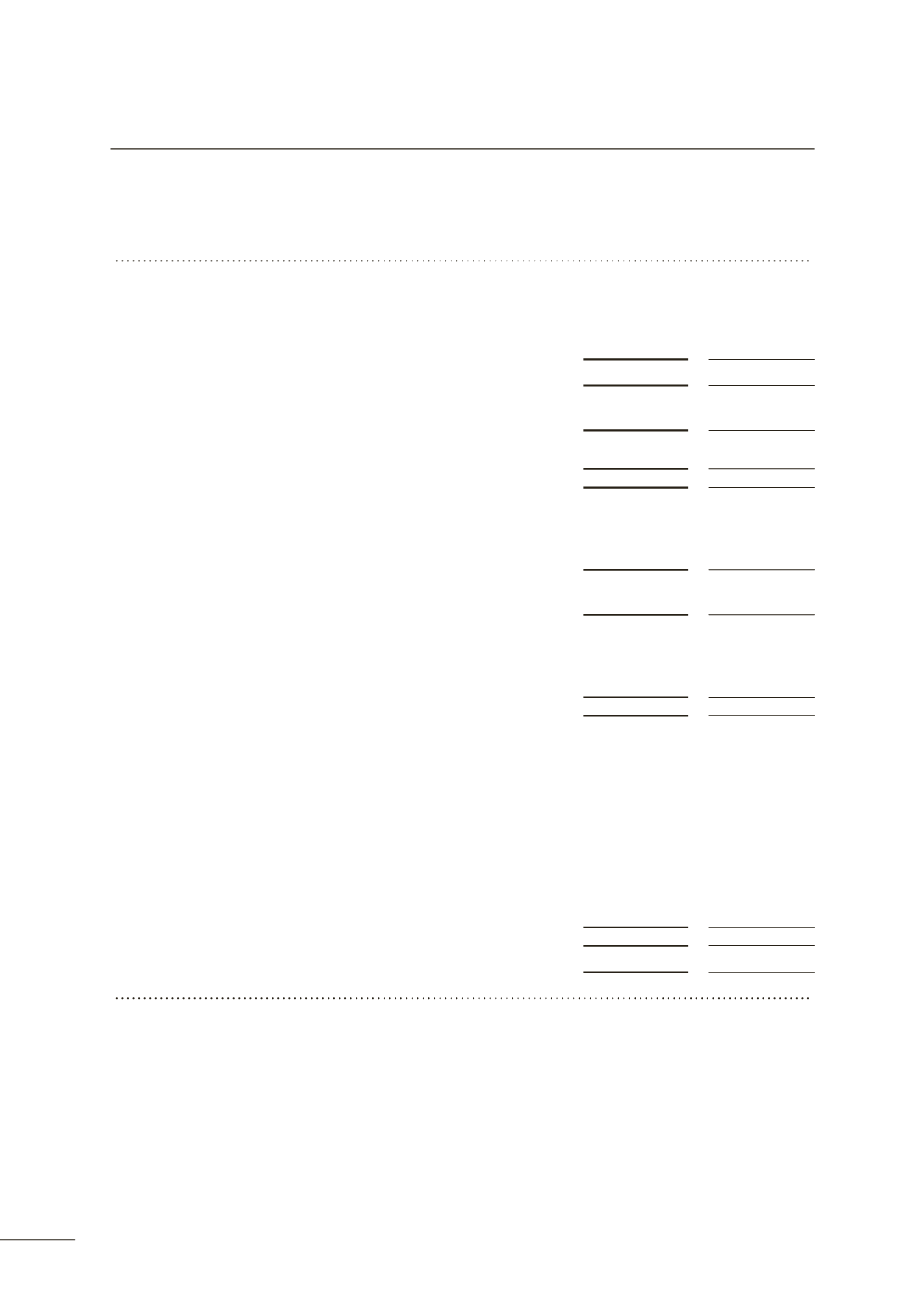

NOTE 40

PARENT ENTITY FINANCIAL INFORMATION

(a) Summary financial

information

The individual financial statements for the parent

entity (Australian Rail Track Corporation) show the

following aggregate amounts:

Balance sheet

2013

$’000

2012

$’000

Current assets

348,930

175,321

Non-current assets

5,077,748

4,519,376

Total assets

5,426,678

4,694,697

Current liabilities

168,417

253,026

Non-current liabilities

1,804,481

1,110,743

Total liabilities

1,972,898

1,363,769

Net assets

3,453,780

3,330,928

Shareholders’ equity

Contributed equity

2,603,226

2,391,526

Reserves

989,596

878,927

Retained earnings

(139,042)

60,475

Capital and reserves attributable to owners of

Australian Rail Track Corporation Ltd

3,453,780

3,330,928

Total revenue and other income

728,783

690,123

Total expenses

(1,028,515)

(837,418)

Finance costs - net

(27,184)

(18,527)

Income tax (expense)/benefit

125,119

(54,357)

(Loss) for the year

(201,797)

(220,179)

Other comprehensive income

Revaluation property, plant and equipment

160,797

-

Income tax effect of revaluation

(48,201)

-

Reversal of revaluation property, plant and equipment

-

(311,874)

Income tax effect of reversal of revaluation

-

93,562

Income tax effect of revaluation

-

1,196

Actuarial (losses) /gains on defined benefit fund obligations

3,080

(5,041)

Income tax effect on defined benefit fund obligations

(924)

1,512

Cash flow hedge charged to equity - interest rate swap

(1,774)

(3,813)

Cash flow hedge charged to equity - foreign exchange

70

99

Net changes in the fair value of cashflow hedges transferred to profit and loss

(99)

7

Other comprehensive income for the year, net of tax

112,949

(224,352)

Total comprehensive income

(88,848)

(444,531)

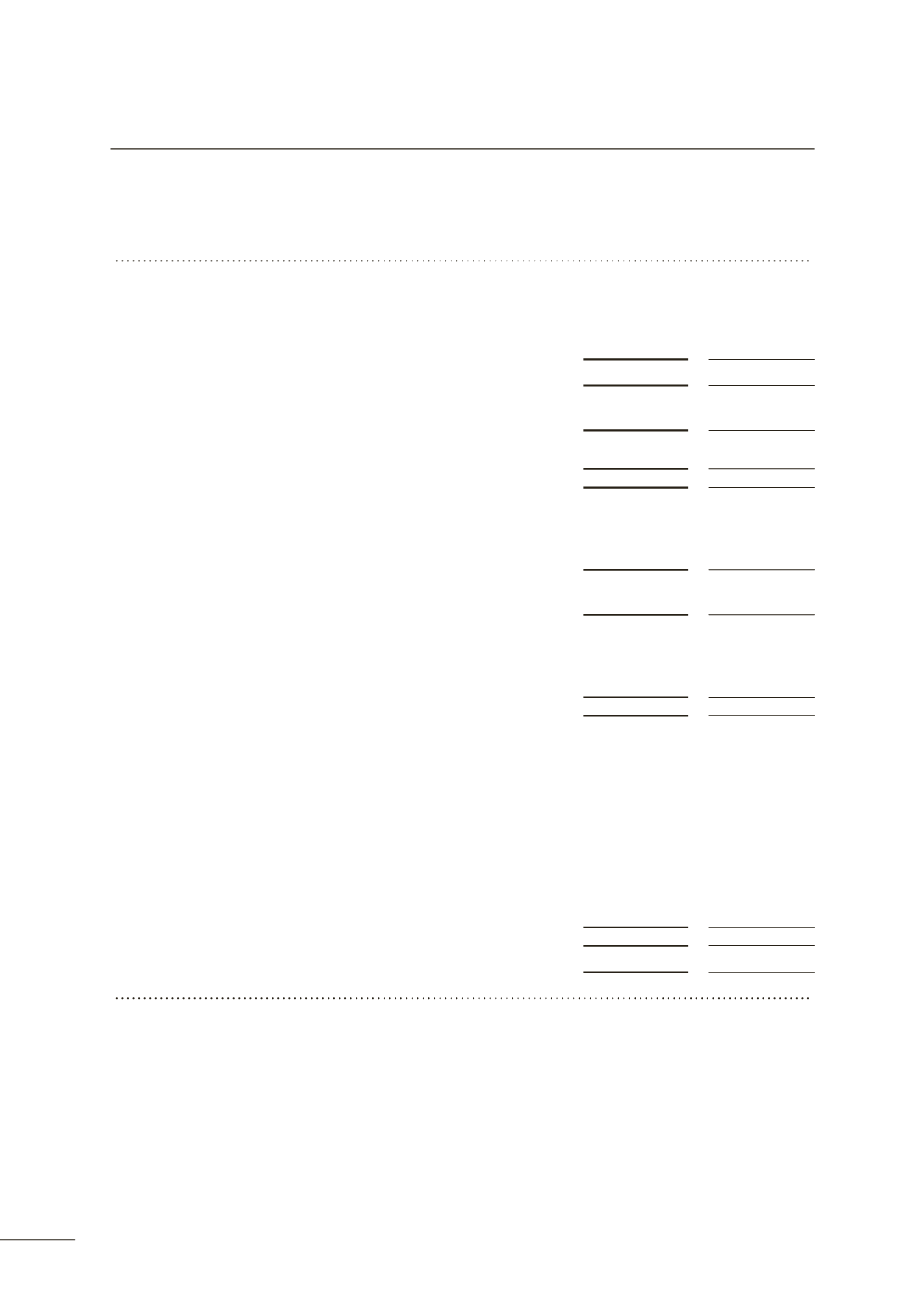

(b) Contingent liabilities of the

parent entity

The parent entity accounts for costs associated with

rectifying rail access related incidents following their

occurrence. Income from subsequent insurance and other

recoveries is only recognised when there is a contractual

arrangement in place and the income is probable of being

received. As a result, certain potential insurance and or

other recoveries have not been recognised at year end,

as their ultimate collection is not considered probable.

(c) Contractual commitments

for the acquisition of property,

plant or equipment

As at 30 June 2013, the parent entity had

contractual commitments for the acquisition of

property, plant or equipment totaling $0.4b (30

June 2012 $0.1b). These commitments are not

recognised as liabilities as the relevant assets have

not yet been received.

104