NOTE 07

INCOME TAX EXPENSE/(BENEFIT)

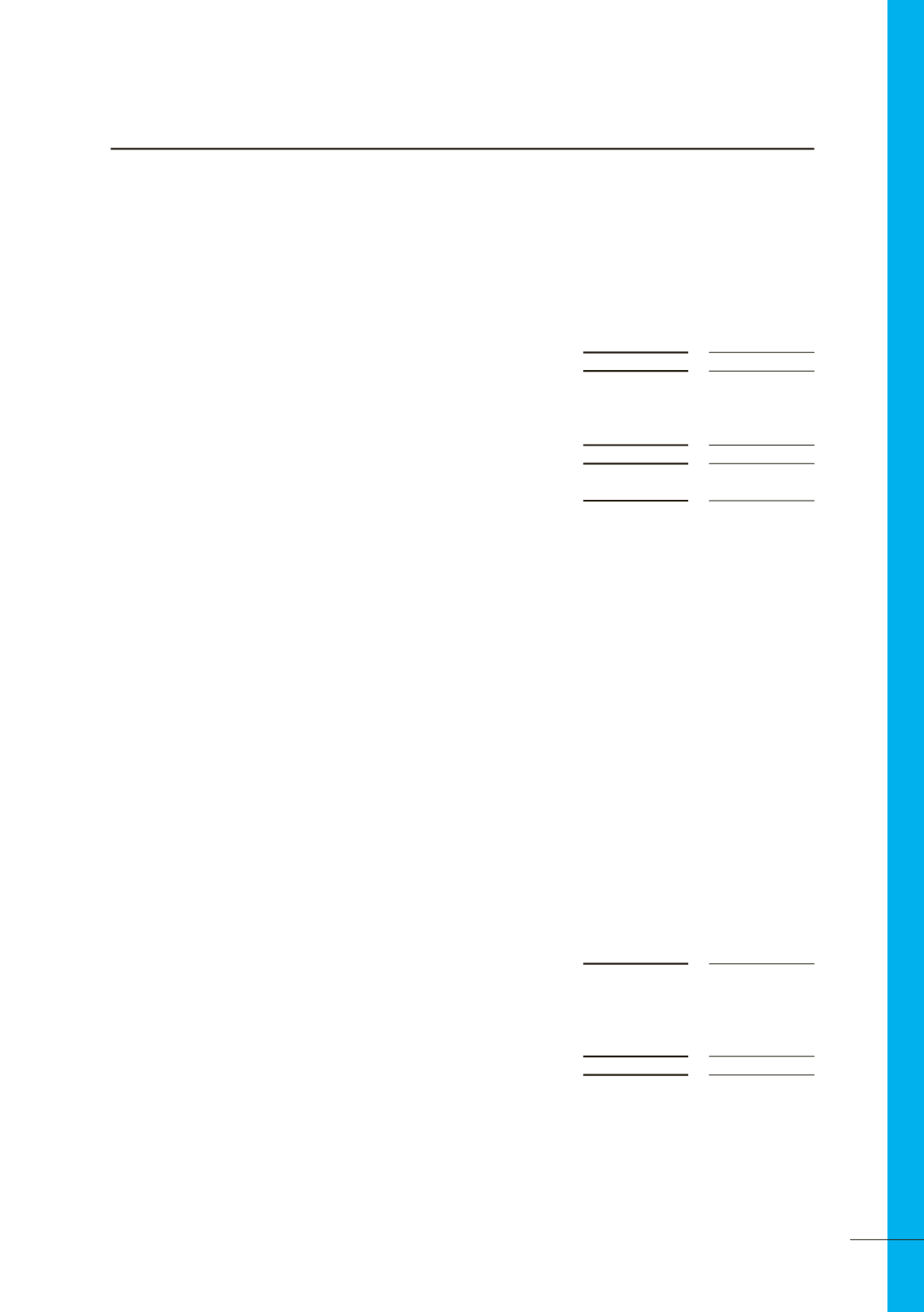

(a) Income tax expense/(benefit)

Consolidated

2014

$’000

Restated

2013

$’000

Current tax expense

Adjustment for prior year

-

(4,072)

Total current tax expense

-

(4,072)

Deferred tax expense

Origination and reversal of temporary differences

56,156

(95,918)

Change in recognised deductible temporary differences

(30,821)

(25,129)

Total deferred tax expense

25,335

(121,047)

Total income tax expense/(benefit)

25,335

(125,119)

(b) Tax assets

At 30 June 2014, the Group has unrecognised deferred tax assets in relation to temporary differences of $251.4m

(2013: $282.3m) associated with the Group’s ability to claim tax depreciation on NSW lease assets utilising

Division 58 of the Income Tax Assessment Act 1997 and also due to the impairment of the assets of the North

South rail corridor.

The Group has an unrecognised deferred tax asset in relation to a carried forward capital loss of $0.7m (2013:

$0.7m). It is not recognised on the basis that there are no forecast future capital gains against which the loss

could be utilised.

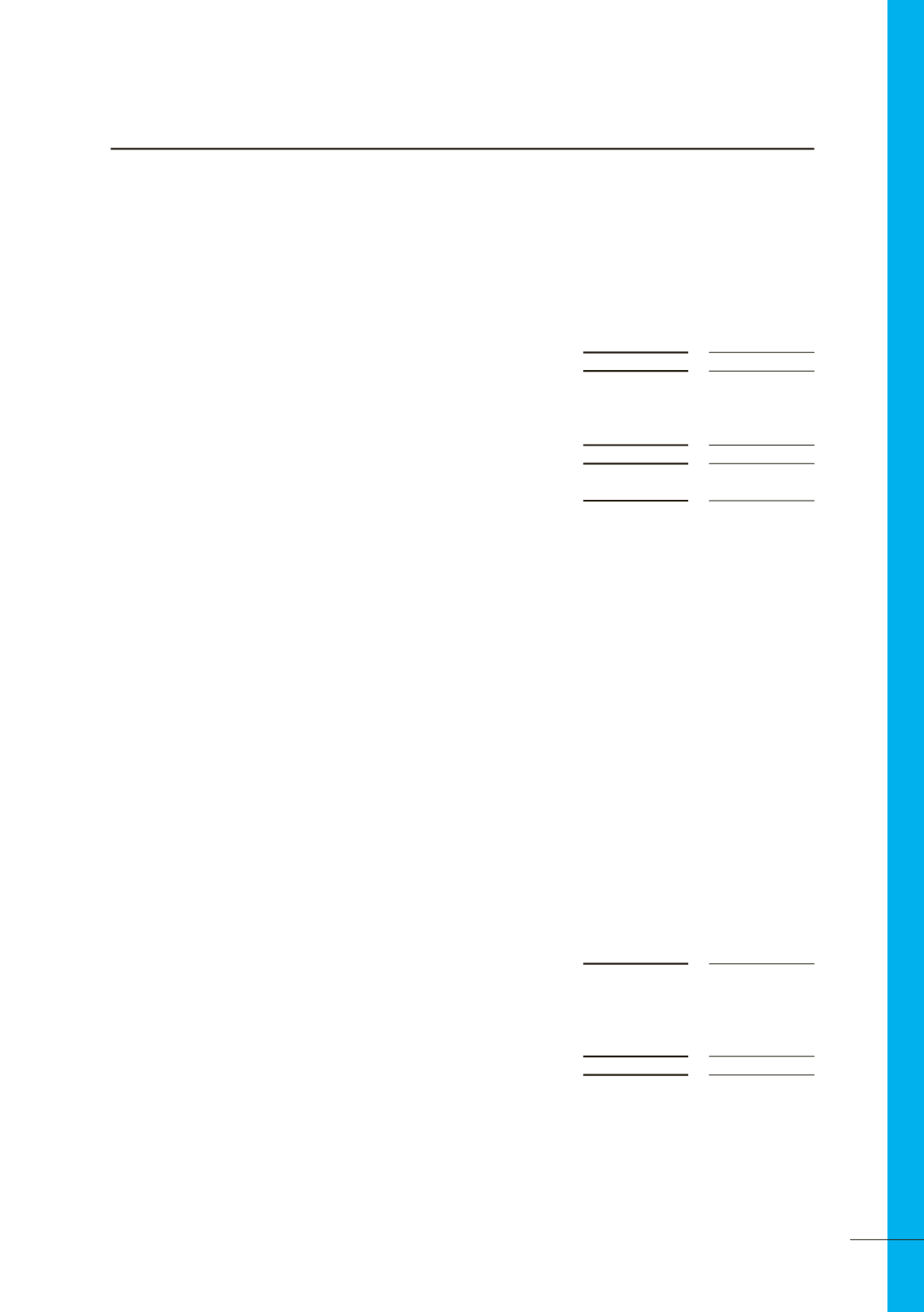

(c) Numerical reconciliation of income tax expense/(benefit)

to prima facie tax payable

Consolidated

2014

$’000

Restated

2013

$’000

Profit/(loss) from continuing operations before income tax expense

188,978

(327,153)

Tax at the Group’s statutory tax rate of 30%

56,693

(98,146)

Change in recognised temporary differences

(30,821)

(25,129)

Adjustment for current tax prior year

-

(4,072)

Research and development income tax offset

(459)

(1,100)

Non taxable items

(78)

3,328

Total income tax expense/(benefit)

25,335

(125,119)

61