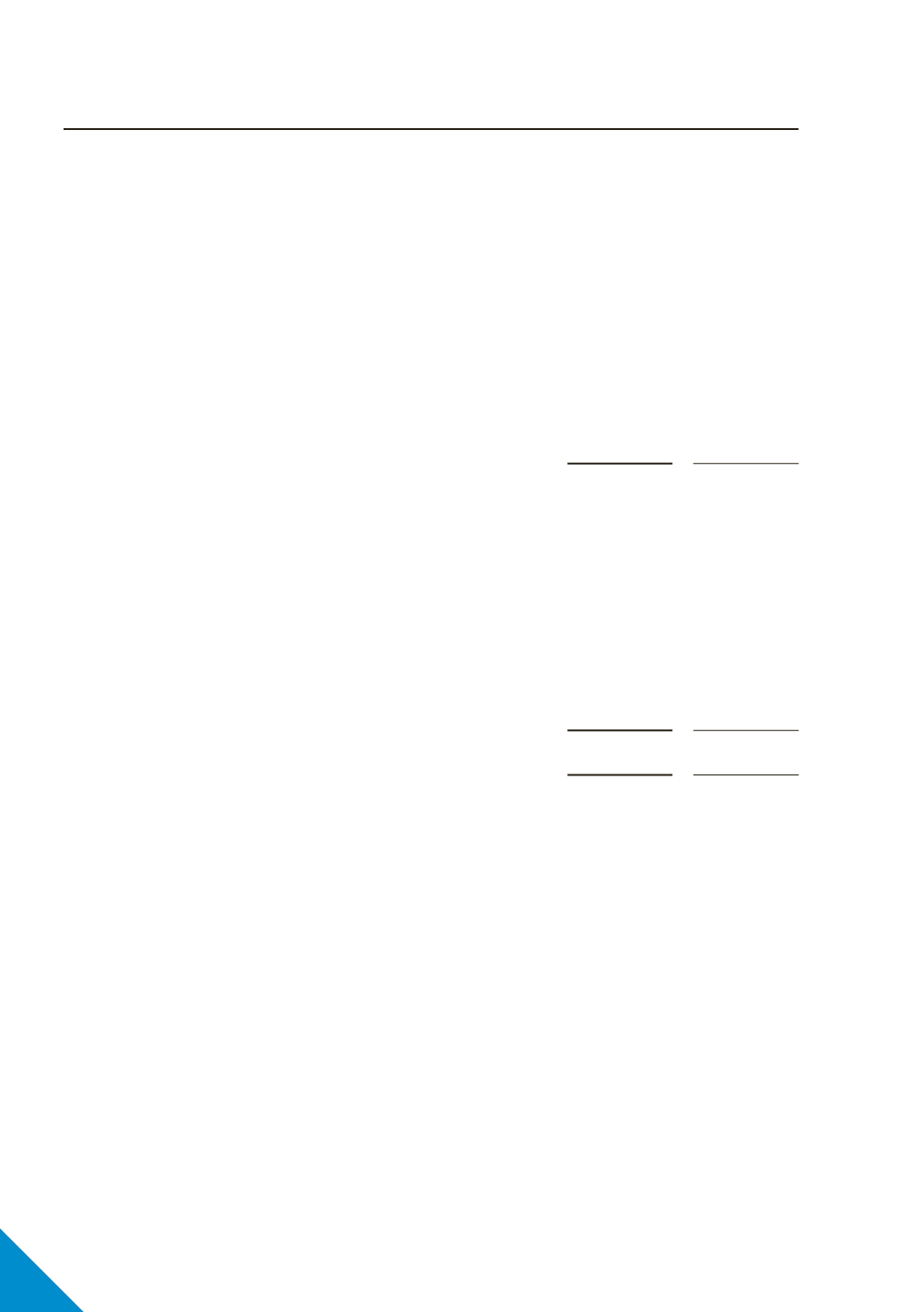

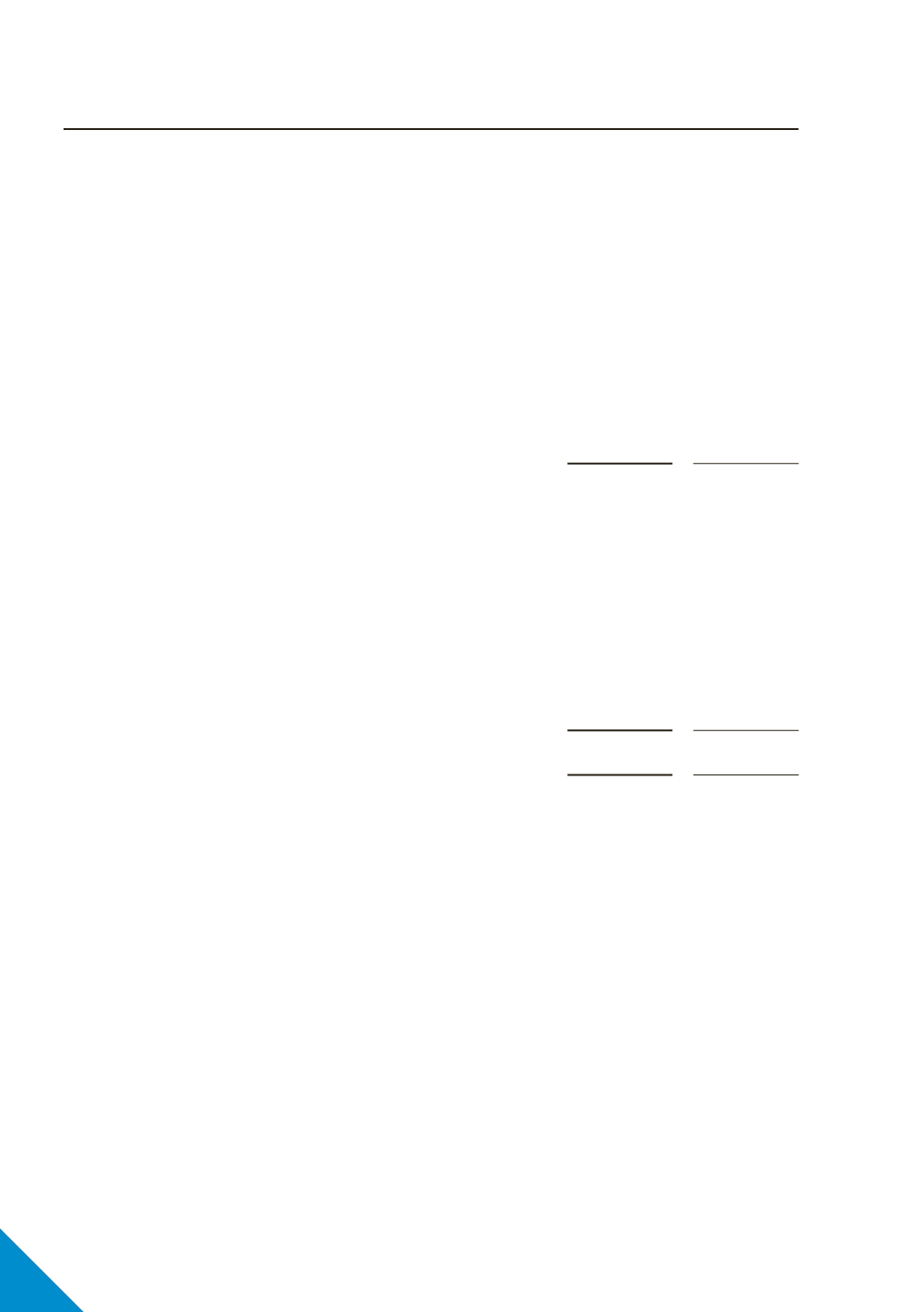

Note 40

Reconciliation of profit after income tax to net cash inflow from operating activities

Consolidated

2012

2011

$’000

$’000

(Loss) for the year

(219,927)

(49,638)

Adjustments for:

Depreciation

135,984

93,746

Amortisation

1,582

1,417

Recognition of impairment loss

290,206

434,235

The recognition of deferred income attributable to financing activities

(25,161)

(20,332)

Net loss/(gain) on sale of non‑current assets

5,894

1,253

Net finance costs

18,527

11,690

Income tax

54,357

(249,435)

Operating profit before changes in working capital and provisions

261,462

222,936

Change in trade debtors and other receivables

41,951

(56,684)

Change in taxes receivable

11,105

7,450

Change in inventories

2,565

222

Change in other current assets

17,654

(2,183)

Change in trade and other payables

(34,262)

31,103

Change in other liabilities

14

(195)

Change in provisions

5,436

2,932

Income tax received prior year adjustment

-

348

Interest paid

(52)

(66)

Net cash inflow (outflow) from operating activities

305,873

205,863

110