NOTE 05

INCOME TAX EXPENSE/(BENEFIT)

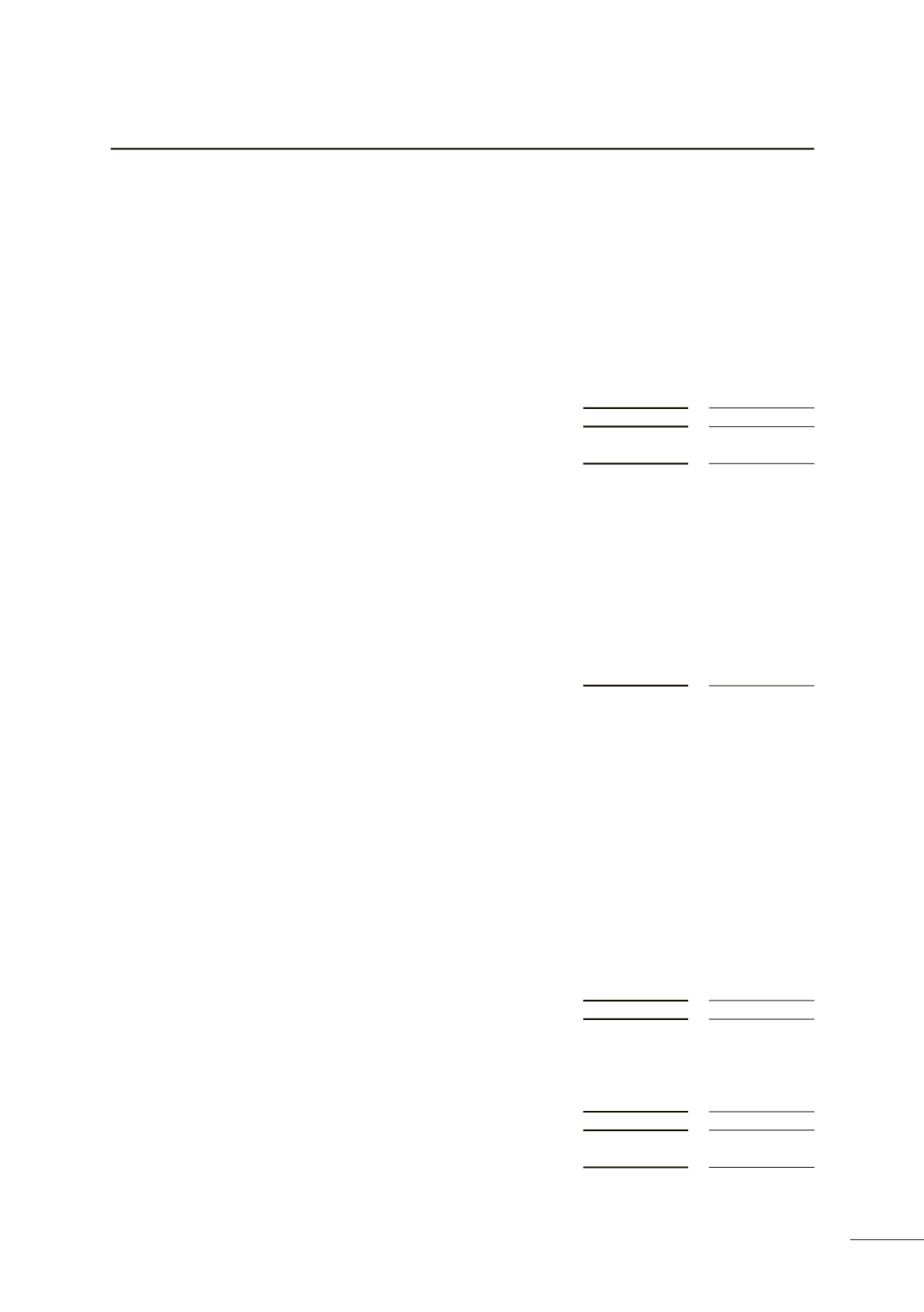

(a) Income tax expense/(benefit)

Consolidated

2013

$’000

2012

$’000

Adjustment for current tax prior year adjustment

(4,072)

-

Deferred income tax (benefit)/expense related to recognition of previously

unrecognised tax losses (note 15)

(6,301)

(9,240)

Deferred income tax expense/(benefit) relating to movement in temporary

differences (note 15)

(114,746)

63,597

Income tax (benefit)/expense

(125,119)

54,357

(Increase) / decrease in deferred tax assets

(125,119)

54,357

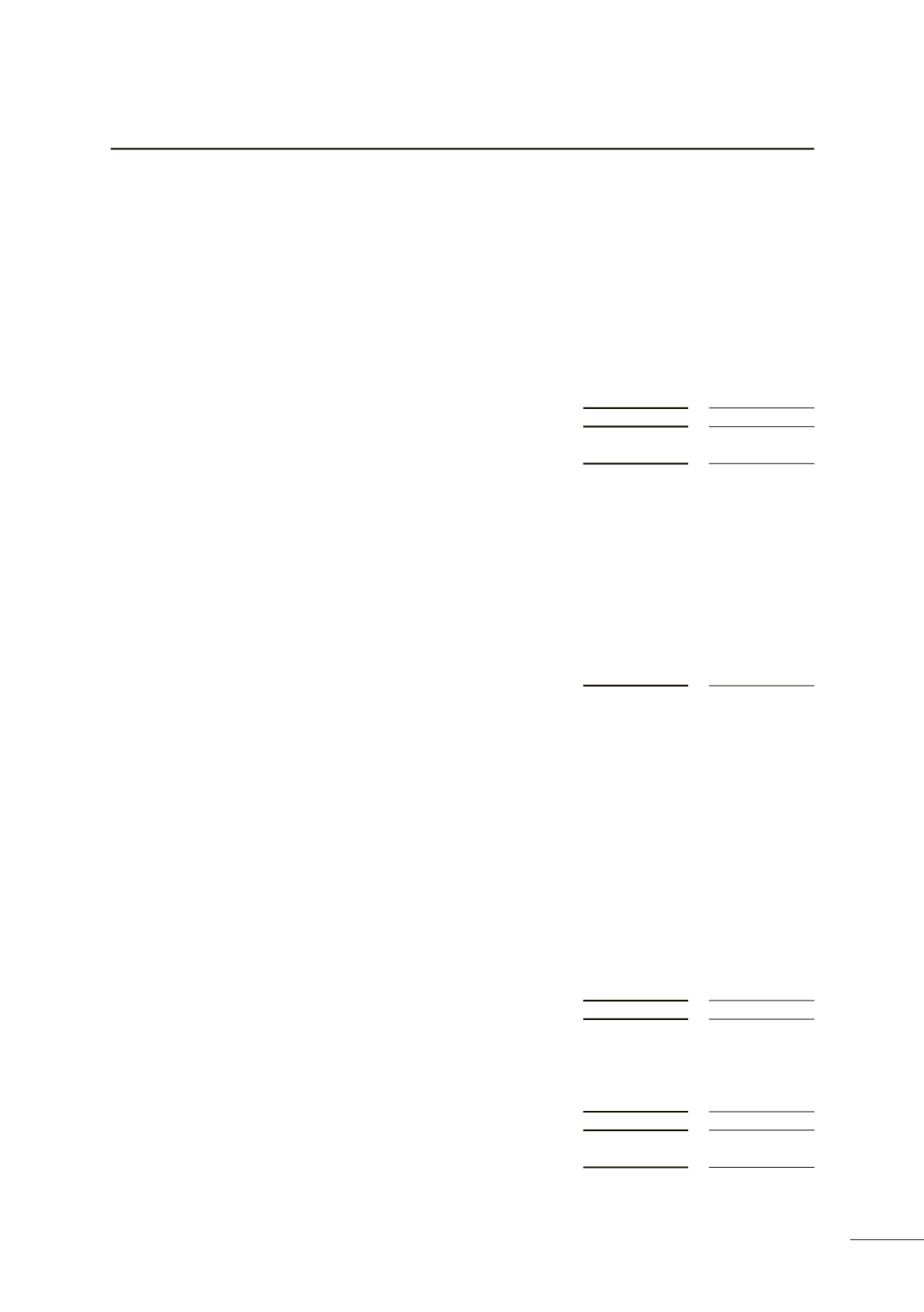

(b) Numerical reconciliation of income

tax expense/(benefit) to prima facie tax payable

Consolidated

2013

$’000

2012

$’000

(Loss) from continuing operations before income tax expense

(326,916)

(165,570)

Tax at the Group’s Statutory Tax Rate of 30%

(98,075)

(49,671)

Adjustments in respect of current income tax

Non-deductible expenses

Adjustments for current tax of prior periods

(4,072)

-

Depreciation & impairment

191,952

128,528

Provisions

300

1,834

Deferred grant revenue taxable in advance

1,996

15,419

Other assessable income

433

73

Loss on disposal

-

1,767

Other

288

113

Deductible expenses

Depreciation

(94,693)

(67,915)

Profit on disposal

(1,221)

(9,971)

Research and Development

-

(7,080)

Other

(8,536)

(4,374)

Prior year tax losses unrecognised

7,556

(8,723)

Current Income tax (benefit)/expense

(4,072)

-

(Increase) in deferred tax assets related to recognition of previously

unrecognised tax losses

(6,301)

(9,240)

Decrease/(increase) in deferred tax assets primarily related to Property, plant

and equipment

(114,746)

63,597

Tax (benefit)/expense deferred tax total

(121,047)

54,357

Total income tax (benefit)/expense

(125,119)

54,357

71