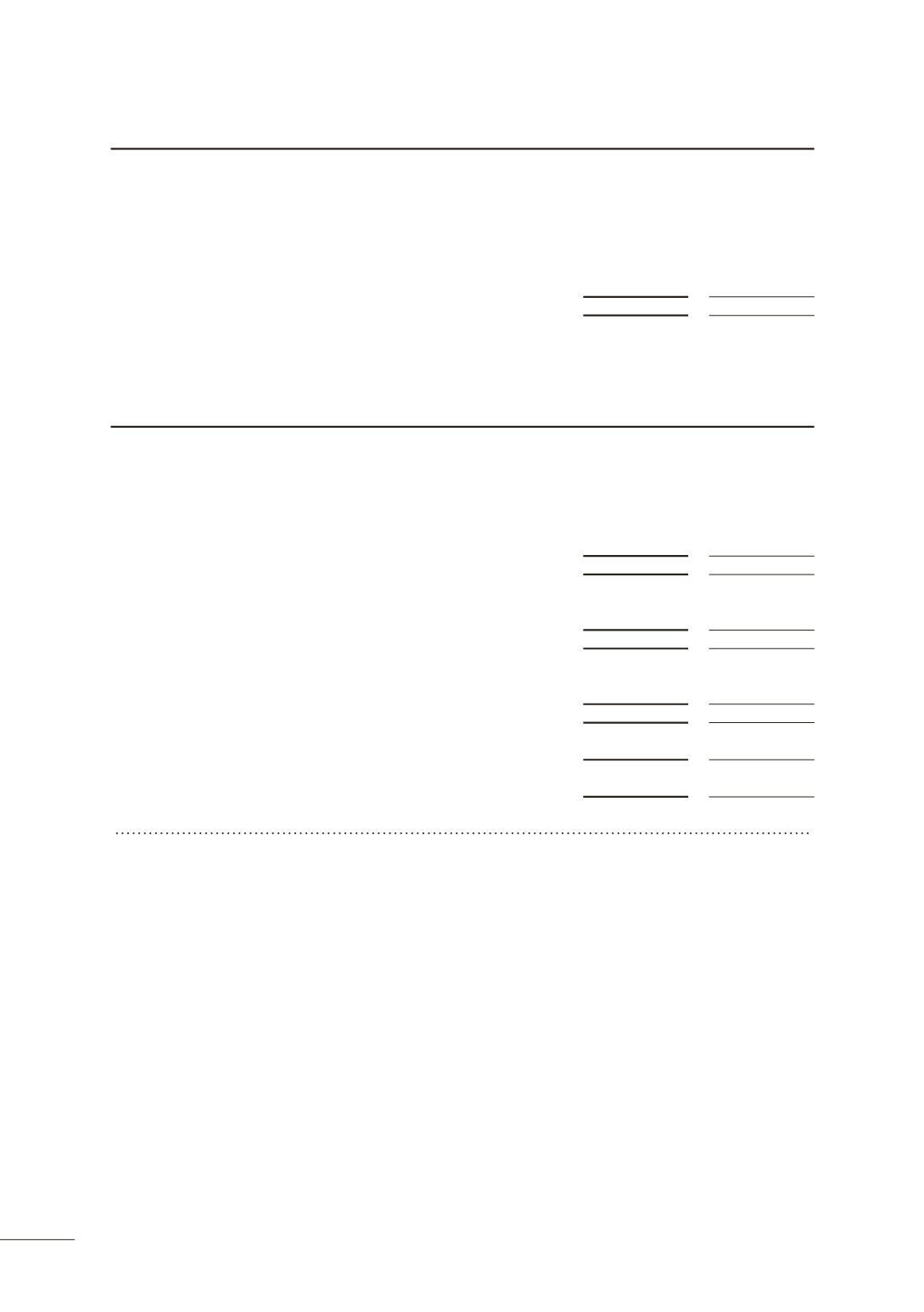

NOTE 10

CURRENT ASSETS – OTHER CURRENT ASSETS

Consolidated

2013

$’000

2012

$’000

Prepayments - other

4,774

3,636

Other current assets

412

532

5,186

4,168

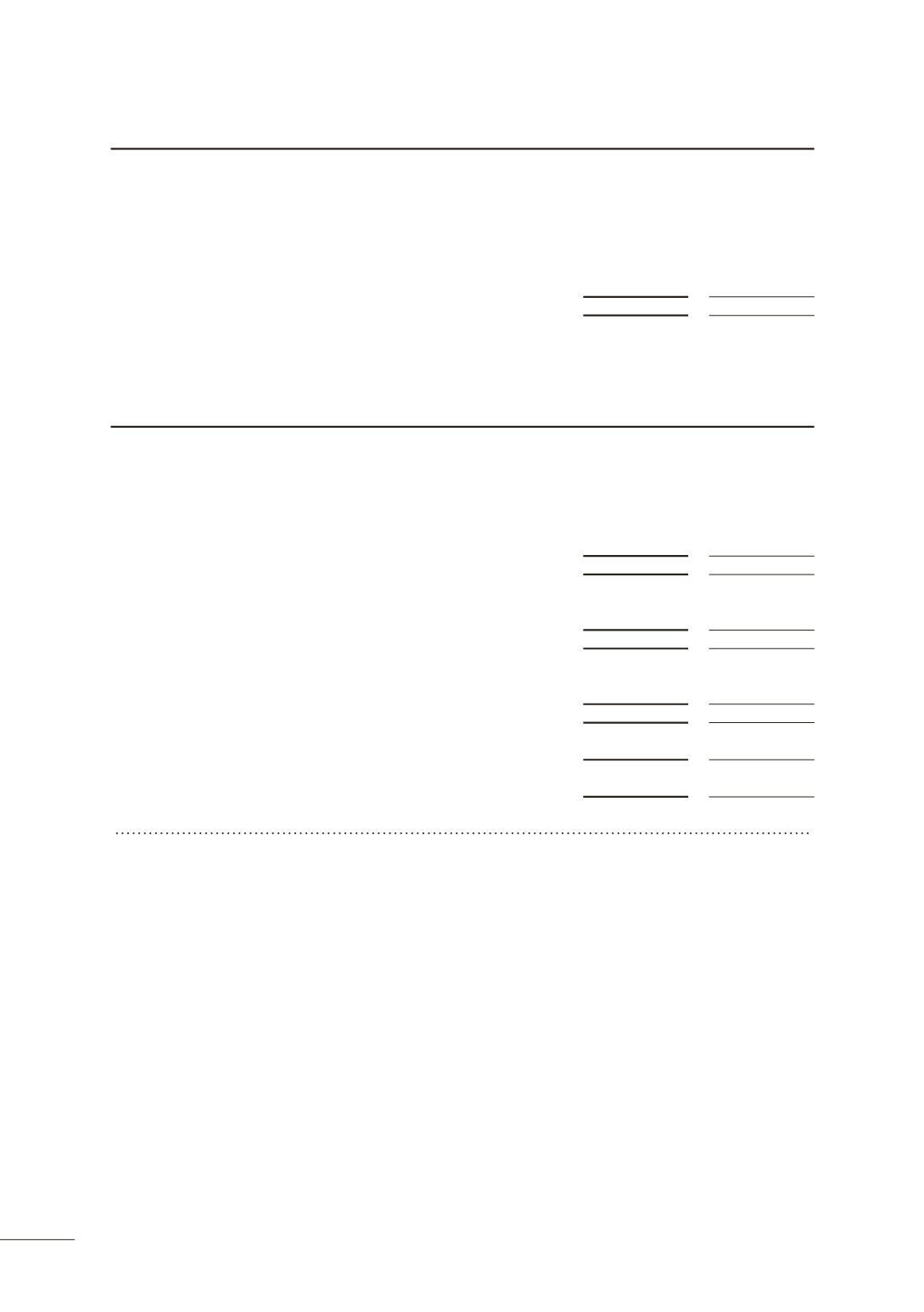

NOTE 11

DERIVATIVE FINANCIAL INSTRUMENTS

Consolidated

2013

$’000

2012

$’000

Current assets

Forward foreign exchange contracts - cash flow hedges (a)

100

175

Total current derivative financial instrument assets

100

175

Current liabilities

Forward foreign exchange contracts - cash flow hedges ((a)(ii))

-

33

Total current derivative financial instrument liabilities

-

33

Non-current liabilities

Interest rate swaps - cash flow hedges (a)

7,981

5,446

Total non-current derivative financial instrument liabilities

7,981

5,446

Total derivative financial instrument liabilities

7,981

5,479

(7,881)

(5,304)

(a) Instruments used

by the group

The Group is party to derivative financial instruments

in the normal course of business in order to hedge

exposure to fluctuations in interest rate and foreign

exchange rates in accordance with the Group’s Board

approved Treasury Policy.

(i) Interest rate swap contracts -

cash flow hedges

In April 2013 the Group as a part of the $750m

domestic note program executed the third bond

issuance of $250m to mature on 29 April 2016. The

bonds were issued 50% as fixed and 50% on a floating

rate which is repayable in 3 years, interest is re-priced

semi annually for the fixed portion and quarterly for

the floating portion and both payable in arrears. As

a result, ARTC was exposed to fluctuations in the

benchmark interest rate (BBSW).

To reduce this exposure ARTC entered into a 3 year

interest rate swap (IRS) on 29 April 2013 to hedge its

$125m floating rate bond issue to a fixed rate therefore

no longer exposed to fluctuations in the BBSW rate.

Only exposure to the quarterly BBSW has been

designated as the hedged risk.

The gain or loss from re-measuring the hedging

instruments at fair value is recognised in other

comprehensive income and deferred in equity in

the hedging reserve, to the extent that the hedge is

effective. It is reclassified into profit or loss when the

hedged interest expense is recognised. In the year

ended 30 June 2013 there was no reclassification

76