NOTE 30

FINANCIAL RISK MANAGEMENT

Overview

The Group has exposure to the following risk arising from financial instruments:

•

•

Credit risk

•

•

Liquidity risk

•

•

Market Risk, inclusive of interest rate risk

This note presents information about the Group’s exposure to each of the above risks, the Group’s objectives, policies

and processes for measuring and managing risk and the Group’s management of capital.

Risk management framework

The Company’s board of directors has overall responsibility for the establishment and oversight of the Group’s risk

management framework. The Chief Executive Officer has established a Treasury Committee, which is responsible for

developing and monitoring the Group’s Treasury Policy and cash management procedure. The Audit and Compliance

Committee regularly receives updates on Treasury activities. The Group’s Treasury Policy is established to identify

and analyse the risks faced by the Group, to set appropriate risk limits and controls, provides a structure to monitor

risk and adherence to limits. The policy is reviewed regularly to reflect changes in market conditions and the Group’s

activities. The cash management procedure supports a controlled environment ensuring appropriate management

of liquidity risk.

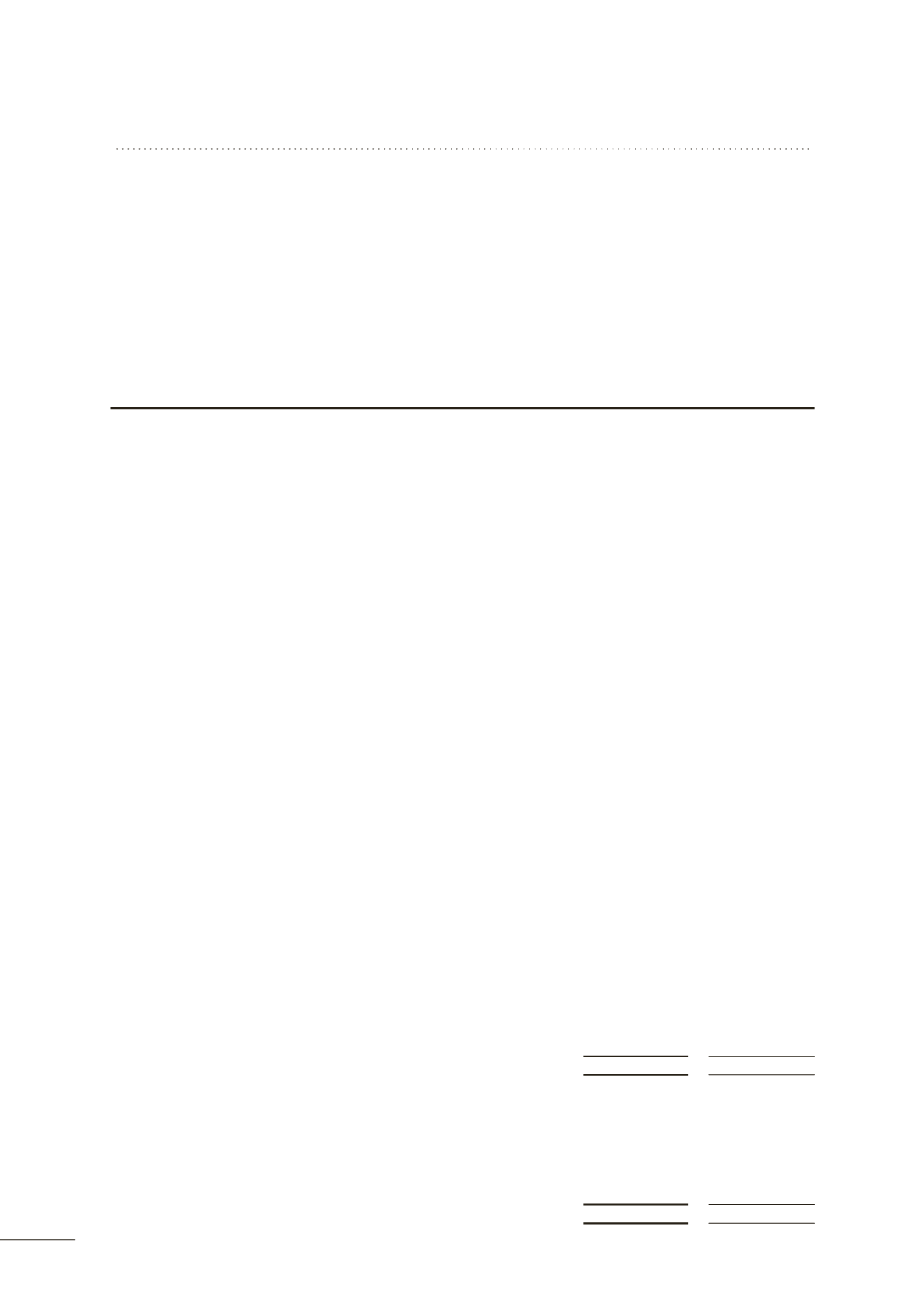

The Group holds the following financial instruments:

Consolidated

2013

$’000

2012

$’000

Financial assets

Cash and cash equivalents

217,375

45,924

Trade and other receivables

95,701

102,870

Derivative financial instruments - foreign exchange

100

175

313,176

148,969

Financial liabilities

Trade and other payables

94,132

157,893

Bond issue

750,231

498,927

Borrowings

329,909

20,002

Derivative financial instruments - foreign exchange

-

33

Derivative financial instruments - interest rate swap

7,981

5,446

Other financial liabilities

400

625

1,182,653

682,926

NOTE 29

RESERVES AND RETAINED EARNINGS (CONTINUED)

(ii) Hedging reserve - cash flow hedge

The hedging reserve comprises the effective portion of the cumulative net change in the fair value of cash flow hedging

instruments related to hedged transactions that have not yet occurred. Amounts are reclassified to profit or loss when

the associated hedged transaction affects profit or loss.

92