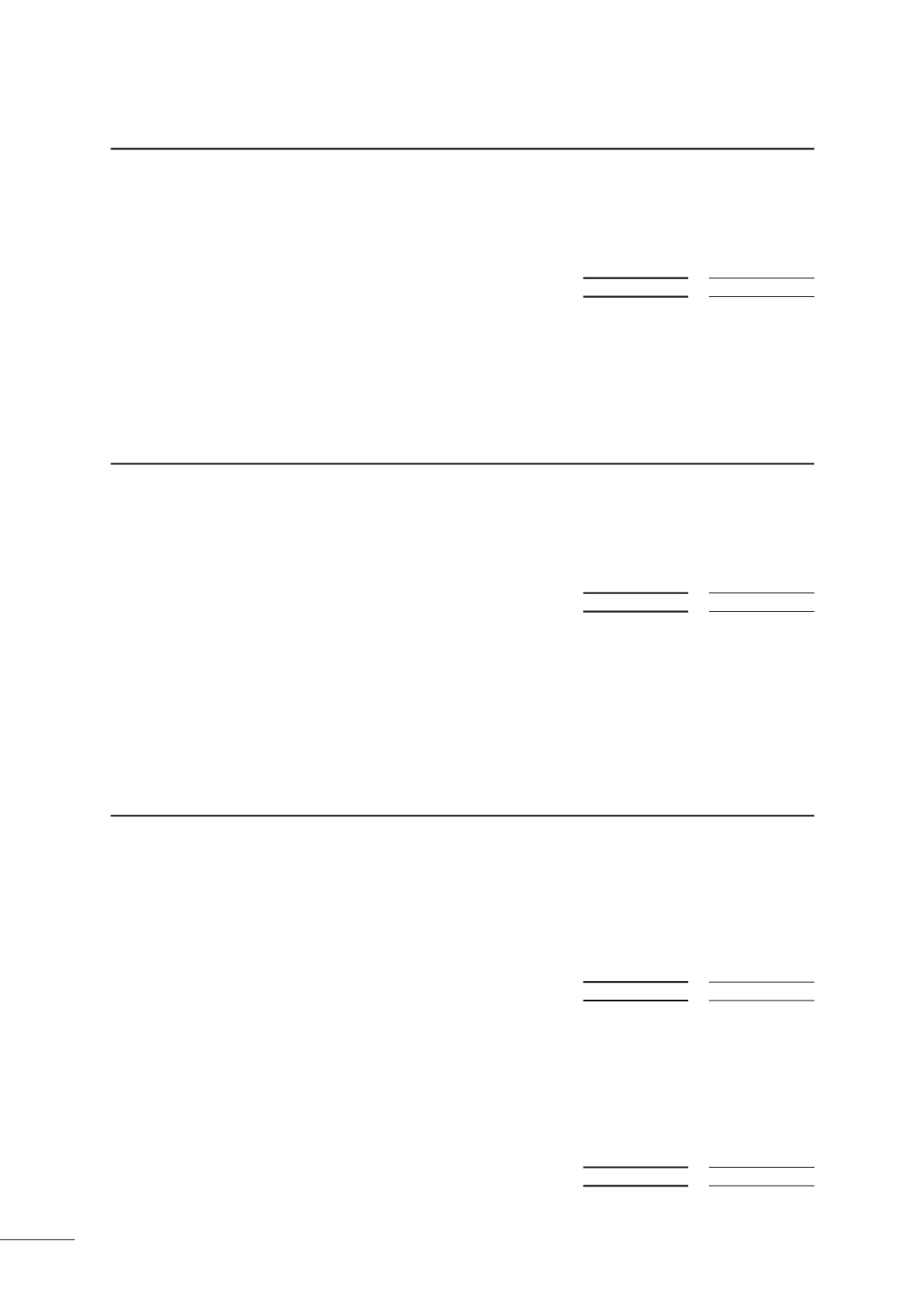

NOTE 23

NON-CURRENT LIABILITIES – DEFERRED INCOME GOVERNMENT GRANTS

Consolidated

2013

$’000

2012

$’000

Government grants

420,504

415,582

420,504

415,582

The government grants received by the Group to 30 June 2013 and classified as non-current are $420.5m.

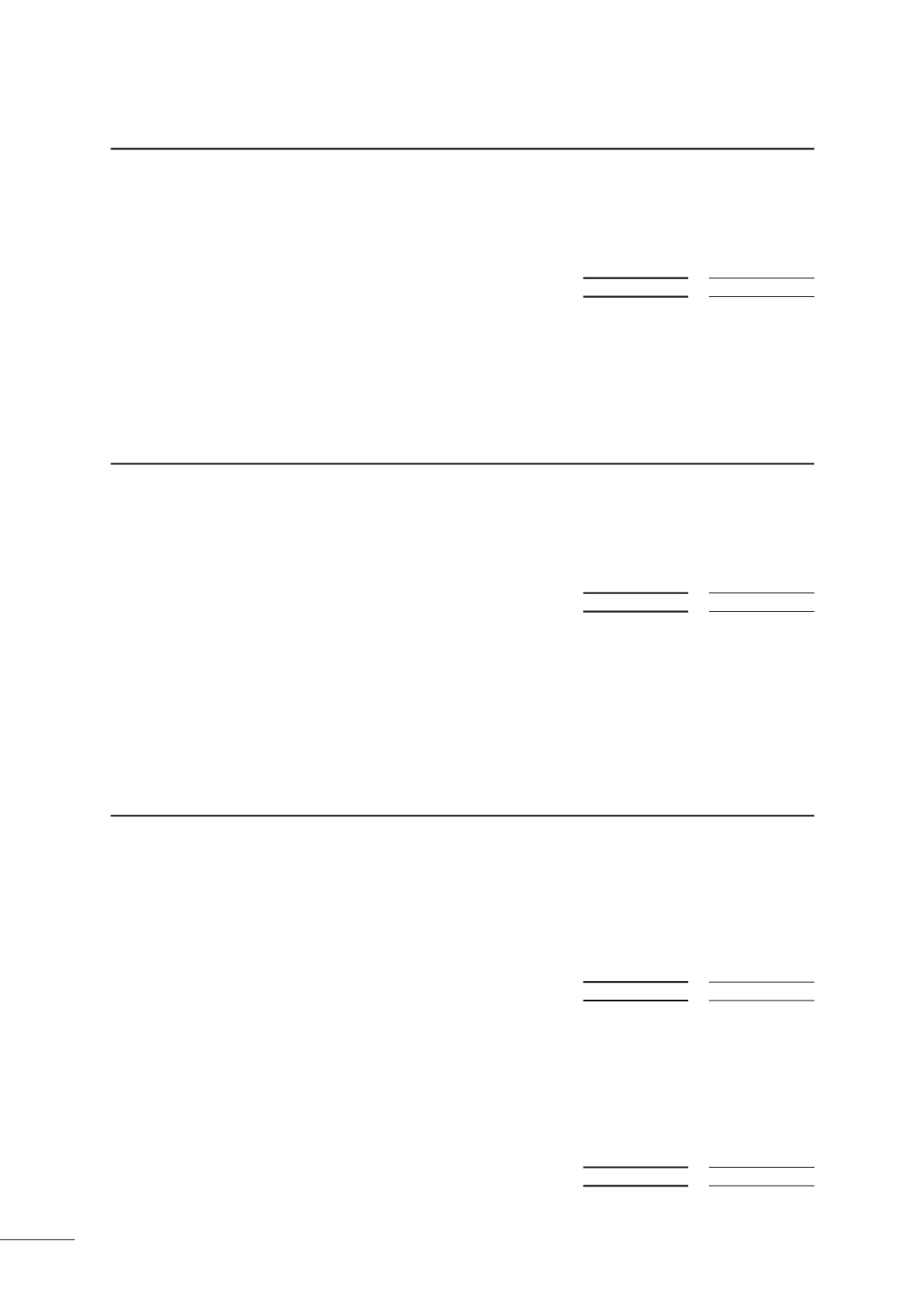

NOTE 24

NON-CURRENT LIABILITIES – FINANCE LEASE

Consolidated

2013

$’000

2012

$’000

Finance lease

84

392

84

392

(a) Interest rate risk is considered negligible.

(b) The carrying amount of the finance lease liabilities approximates fair value.

NOTE 25

NON-CURRENT LIABILITIES – DEFERRED TAX LIABILITIES

Consolidated

2013

$’000

2012

$’000

The balance comprises temporary differences attributable to:

Property, plant and equipment revaluation

281,587

174,905

Cash flow hedges - foreign exchange

30

52

Net deferred tax liabilities

281,617

174,957

Movements:

Opening balance at 1 July

174,957

267,271

Charged to equity related to cash flow hedge – foreign exchange (note 5(c))

(22)

52

Credited to the other comprehensive income

48,201

(93,562)

Reclassification of DTA/DTL relating to property, plant and equipment

58,481

-

Income tax effect on asset disposal in asset revaluation reserve

-

1,196

Closing balance at 30 June

281,617

174,957

86