NOTE 05

INCOME TAX EXPENSE/(BENEFIT)

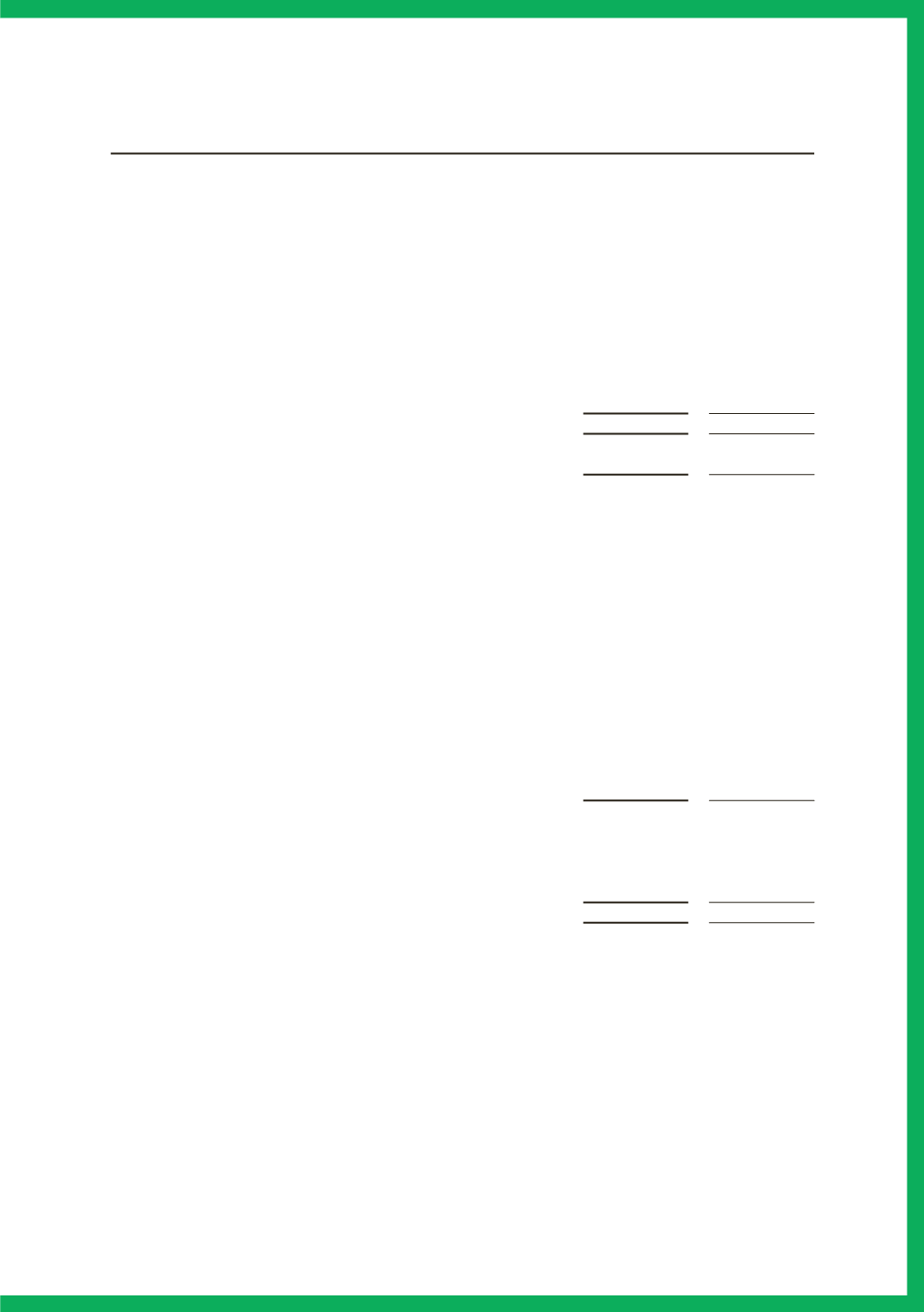

(a) Income tax expense/(benefit)

Consolidated

2015

$’000

2014

$’000

Current tax expense

-

-

Deferred tax expense

Origination and reversal of temporary differences

56,806

56,156

Change in recognised deductible temporary differences

(3,370)

(30,821)

53,436

25,335

Total income tax expense/(benefit)

53,436

25,335

The Group’s current tax expense for the year ended 30 June 2015 is nil (2014: nil) due to the

existence of tax deductions available to the Group as a result of the Group’s ability to claim tax

depreciation on NSW lease assets utilising Division 58 of the Income Tax Assessment Act 1997 and

deductions for carry forward tax losses and offsets generated in previous years.

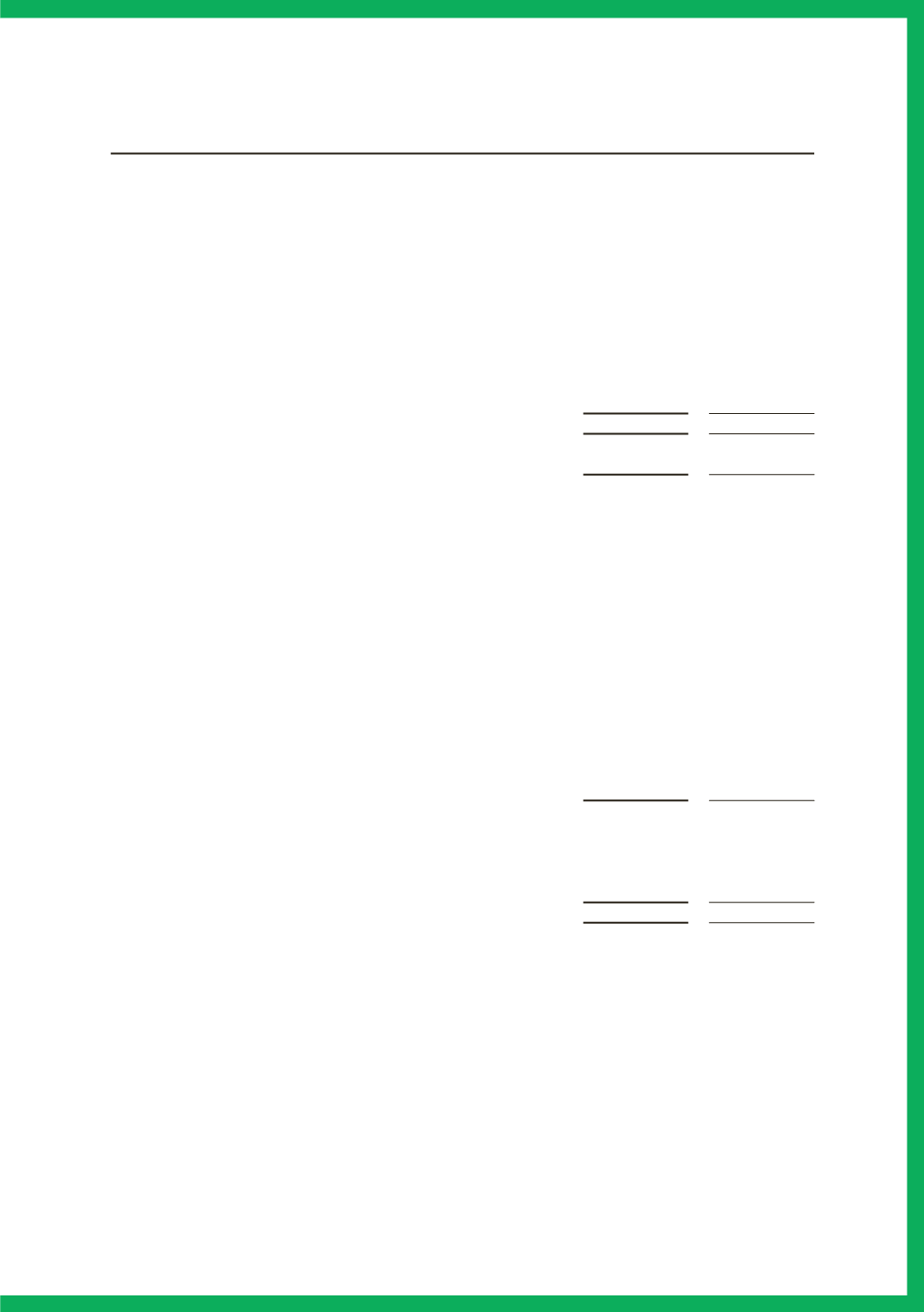

(b) Numerical reconciliation of income tax expense/(benefit)

to prima facie tax payable

Consolidated

2015

$’000

2014

$’000

Profit from continuing operations before income tax expense

188,034

188,978

Tax at the Group’s statutory tax rate of 30%

56,410

56,693

Change in recognised temporary differences

(3,370)

(30,821)

Amendments and prior year adjustments

627

-

Research and development income tax offset

(250)

(459)

Non-taxable items

19

(78)

Total income tax expense

53,436

25,335

69